- Answered the why Made visible the importance of the backstage and operations teams, giving leaders who set out to deliver a technology an opportunity to own their service in the round, measurably moving the customer satisfaction numbers.

- Innovative redesign The UI design is built using interaction metaphors that are already familiar to the target user-base. The front end is also removable for a pure MACH approach.

- Optimized performance Customer effort score (CES) started high and performed well against the support teams previous product families and other units in the bank.

Project situation

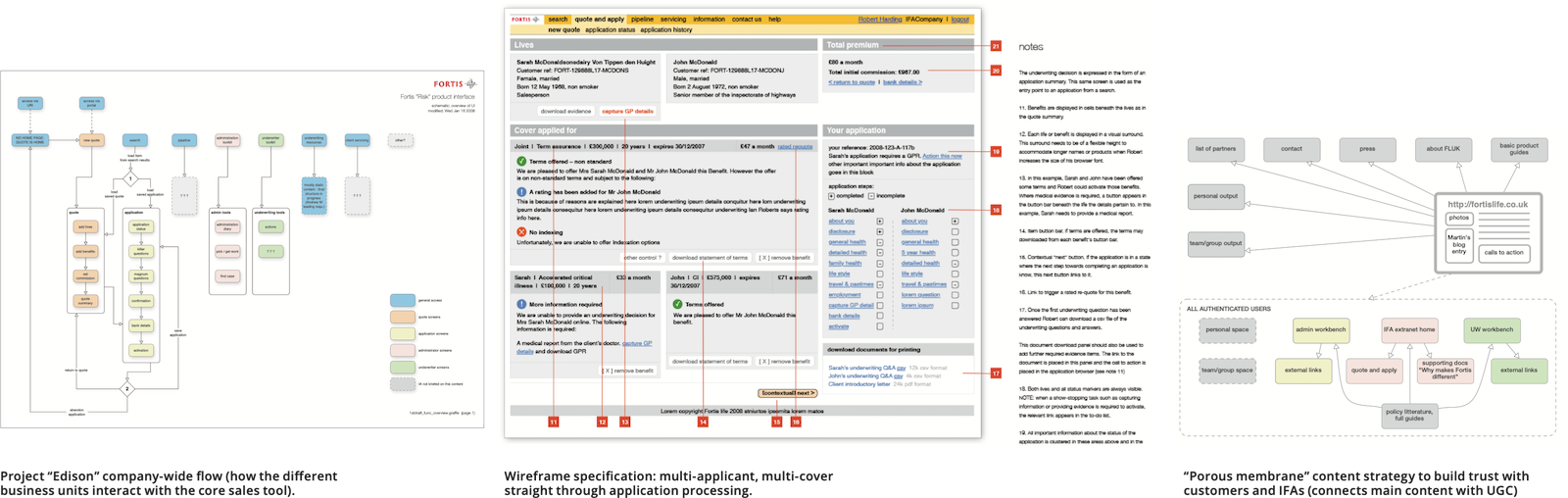

A City insurer needed to launch a large and very complex multichannel transactional service, but a lack of UX research and process was threatening delivery.

I recruited designers and established Agile UX processes. I led an extensive discovery phase, interviewing potential stakeholders and users and analysing context-of-use by shadowing call-centre operators on live customer calls and testing prototypes.

Working closely with the managing director, I converted the Fortis brand values into interactions and established functional branding through the use of interaction principles.

Action and outcomes

I was commissioned as an independent contractor to set up a UX team, research the service and design the service as part of the Agile software development function.

My primary research with both customers and back-stage actors, as well as my establishing of customer journey mapping as a practise, resulted in a product that was not only game-changing but overtook its nearest competitor in its first three months of operation.

Success metrics include:

- Scored 9.5 out of 10 in “Which”, their highest rating ever

- Big efficiency gains and 60% immediate decisions (ie without call-centre intervention)

- First year customer satisfaction survey showed 97.5% customer satisfaction

- Product experience rated F&TRC “eee” excellence (highest industry rating)

Activities

- User research including interviews, live call-centre shadowing

- Stakeholder workshops

- Product backlog management

- User needs analysis

- Creative direction

- Interaction design

- Prototyping

- Wireframe specification

- UAT acceptance criteria

Can I help you solve a similar problem? dug@goodlookslikethis.com